Sometimes it isn't the biggest trade that brings the most joy. What I'm saying is that a half-baked idea so impulsively formulated that I didn't think to throw the trade through until seconds before market close on Friday...

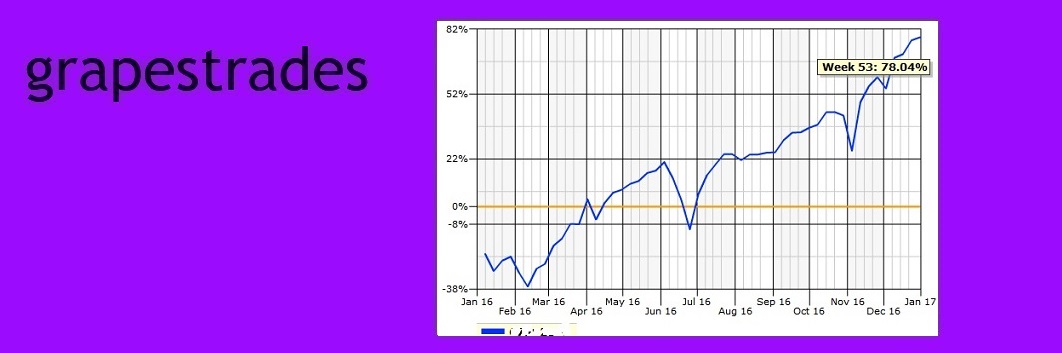

(see illustration below:)

...turned into an instant money-maker that grew to all but 15% of its full potential value less than one trading day after the crazy wish-making order was incredibly filled.

So what do you think I did? Instead of waiting four more days to find out if the tide would turn against me and if the tide might contain sharks and jellyfish, I just cashed it right in today. Someone else took ten cents, and I thought I would probably not unload it for five, but in another wish-making fishing-line-throwing, I just cast my line to see if anything would bite.

Instant fill! No more worries about SVXY holding a knife to me up at the 98 level. I really, really, didn't want to be responsible for selling someone $78,400 worth of that security. Wow, what a way to make $213! There has got to be an easier way. (Just kidding. I'd do that any day, a dozen times over, for $213 while I sit here and exchange bon mots with other traders on twitter.)

In my excitement, I neglected to thoroughly explain this: The opening order was timestamped received at 03:59:47 on Friday as pictured, and I assumed it got swept away with the deadwood, but to my amazement, at 04:04:49, the order was filled and this short-lived but fun-filled adventure got started.

It's the timing and the price on entry and exit that made this a fun one, not to mention the way I no longer have to think about SVXY cornering me into some social obligation I'm not prepared to fulfill. I really didn't want to attend the 98-strike party and was looking for a way to gracefully decline just as soon as I accepted.

If $213 doesn't thrill you - well, every trade cannot be a ball hit out of the park. Look back to some of my earlier posts in the month for more exciting fare - and I still have something in the works for this Friday.