At my last writing I had taken an accounting-sheet loss by simply exchanging one security for a comparable one and then selling some options against that position with the intention of bringing in some extra return on that position. Refresher:

Converted to: (shown after just a few minutes as the position immediately resumed producing red ink):

Well, what happened to those during the earthquake that was election night and the days leading up to it? I said I'd report back on my bag of Halloween goodies (or NOT-goodies), and here is the answer:

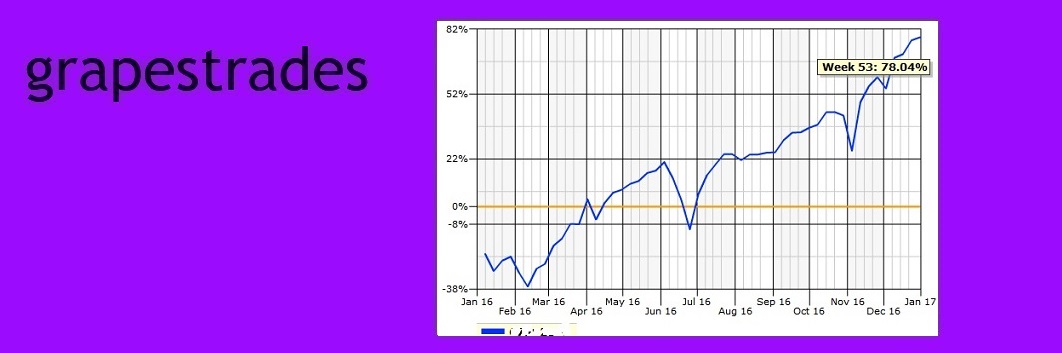

The going got rough, but I got going and worked to repair those positions (some repairs handled poorly and some better executed) until my account, as shown below in an entire-year view, bounced back:

What became of the above-depicted positions during the turbulence that transpired over the first several days of November and during the presidential election? I got nervous about the short puts connected to my short UVXY shares and cashed them in on November 1 for a tidy profit, as shown below:

Then, I did the same thing again on November 7th, also as puts to cover that same position of associated short shares, but closed them out for a loss. (see below)

I don't remember the exact rationale for that move, but I believe I was worried that the puts would limit my profit, and I wanted to close the position and consider opening another one later. As it happens, my prediction that UVXY would hit the 13.50 strike by the November 11th expiration (an undesired - albeit acceptable and anticipated - outcome in my mind) was somewhat on-target! On November 11th, UVXY was all over the map but closed the day at 13.54, just pennies above the strike price. It spent a lot of the day in the 14s, even looking 15 in the eye, and dipped to 13.43 just to freak out traders [of those particular options], before settling on the hairsbreadth gavel-drop of four cents above that option's strike.

I, of course, had long been out of it, making hay while the sun shone for the remainder of November. Aside from the options trades described above, my trades consisted of short UVXY and TVIX shares (and just one lot of TNA), and the results are shown below. For some reason too boring to go into, I changed my closing lot selections from LIFO to FIFO and back several times, so some of the profits are on lots opened earlier the same day, and some are on lots opened as far back as October 31st, the day of my last blog entry. Some are associated with the options discussed above (you'll see the close of the 1,100 shares from in the second graphic, for example. Just look for the 15.95 entry price to see those two lots; they were bought to cover at an average of about 15.21.) The block of TVIX closed for a large loss was "converted" to UVXY with the purpose in mind of selling options against it, and we already talked about those.

As enjoyable as it's been to type this up and chop and crop all the screen shots, I must get back to watching the shares I have outstanding, once again with an uncertain fate. But I returned, as promised, to reconcile my misdeeds with you readers, and you can be sure I'll do it again. Maybe this time before an entire month has gone by!

Oh, before closing this entry, I forgot to mention that I had to sit through uncomfortable adversity on those shares before booking the nice profits you see above. It wasn't an intentional glossing-over, but more like something I've put behind me since it was weeks ago (I hope there's no reprisal in the short-term, though.) Just a little taste of it, if you'd like to see, went like this: