Going back to December 4th, I left off in the middle of the day and promised to be back soon and detail the trading for the remainder of the day. Though time has passed, has SVXY been doing anything different? Have stocks been doing anything other than more of the same (new all-time highs) and has VIX been doing anything other than pedal like a bicycle between 11 and 9 and back again like the rising and setting of the sun, reliable and repetitive? VIX nearly reaching 12 (a big spike, these days) on December 4th enabled me to have a little fun in the afternoon before bringing in all my chips and doing a final tally.

Follow the numbered steps and note the timing, down to the minute, that was required to bring in a few dollars on this ship-in-a-bottle.

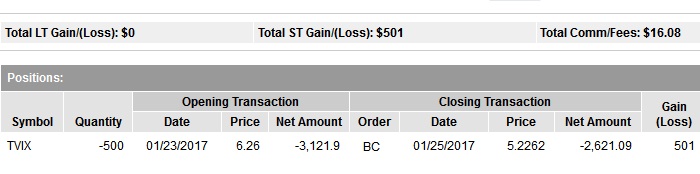

1. At 11:25 in the morning, I sold short a modest mess of SVXY at the price of 114.05.

2. At 1:13 and 32 seconds I bought calls for the 115 strike, December 8th expiration, for 2.75 each in a quantity to match the aforementioned mess plus the disaster-sized portion I planned to sell short immediately after purchasing these.

3. At 1:13 and 58 seconds (pretty close to immediately after the above step), I sold short 2.5 times the quantity I had originally sold short, this time at the price of 115.38. If you are good at algebra, and if you knew my final basis, you could probably compute the quantities. Anyway, I now had a landfill-sized mass of short SVXY at an average price per share of 115.00 even.

4. Way before the end of the day, at 2:45 and 48 seconds, I sold to close the calls for 1.94 each or translated into the multiplier of 100, that's $194 against my $275 buying price, or a loss of $81 per contract.

5. Nineteen seconds later at 2:46:07, I covered all shares at 113.75, or a $1.25 profit per share, coming out to $125 profit per block of 100 shares. My net profit equaled $44 per block of 100 shares.

Why did I do any of the above? Well, obviously, I was trying to capitalize on some downtrend in SVXY when I sold short mid-morning. When, an hour later, it appeared obvious that I had mis-timed my short, I decided to get trader's revenge by doubling (plus) down. But this would be an unwieldy amount of short shares. To limit risk I bought calls so that, should disaster strike and SVXY rise to the moon every day the rest of the week without stopping, I could cover at the same price I had sold shares short by exercising the calls. My cost would be the total cost of buying the calls. So, I bought calls at the 115 strike and then rolled up sleeves (kidding; I was working so fast there was no time to roll up sleeves) and shorted the appropriate additional number of shares less than 30 seconds later. Funnily, without trying to achieve this down to the penny, when I sold the new shares at 115.38, this averaged out with my original shares to produce a new basis of exactly 115.00.

Now I had a small country's GDP worth of SVXY short and protective calls to match that risk.

After a nice trip down the stairs around 2PM, and not being clairvoyant, I decided to exit the whole set of obligations (referring to the shorts) and expensive privileges (referring to the calls). It looked like I could sneak out without anyone realizing I had cut a city-block corner by going in one revolving door and out the other and in between, had been lucky enough to see cash sticking out of the lobby trash can. I played with fire and escaped being burned and decide to get out while the gettin' was... well, possible.

Of course, seeing the rest of the day unfold made me wish I had left the shares uncovered a little while longer; outrageous victory would have been mine. But notice that hike up right before the tumble down the mountainside right after I exited the position: Could I have withstood the red ink on those shares, had I dispensed with the calls and just held the shares naked? With SVXY touching 114 and a half compared to my 115 basis, and having just taken a calculated loss by ditching the calls, I'd say NO. Since I had booked an $81 per contract loss on the calls, I couldn't close my shorts for less than a 0.81 difference, or I'd go from gain to even to loss faster than a one-minute candlestick can form. 114.50 from a 115.00 starting point would put the whole deal solidly into money-losing territory, and how could I know how much higher SVXY would climb? This illustrates the necessity, in the prudent and rational side of my mind anyway, of being disciplined enough to close the whole trade out at once, or at the very least, watch it by the second if choosing to go naked-and-reckless.

With the calls sold at a loss and the shares covered at a gain bigger than the call loss, I declared the day a success, resolving that I wouldn't play with dangerous quantities of volatile securities again, at least until the next day.