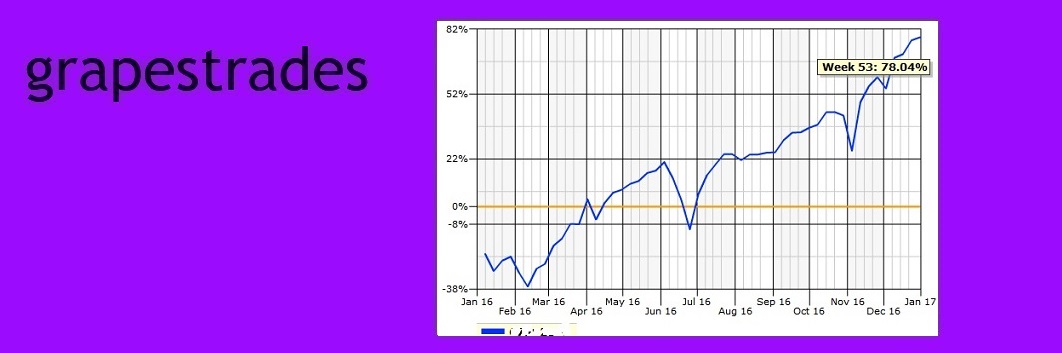

A trading friend of mine, who wishes to be called "Chip" in the telling of this story, is clamoring for me to tell this story on his behalf. The brief but detailed saga is basically a chronicle of Chip's studious, calculated transactions that allowed him to benefit from a particular company's stock price trajectory over the one week span of time covered by this case study. It's a tale of Shake Shack, puts and calls, and of cash raked over the barrelhead into Chip's sweaty, eager hands.

On April 15th, noticing that Shake Shack had been trading four cents shy of $39 during the morning and was somewhat above $38 in the afternoon, Chip scouted out attractive puts to sell. With cash set aside to secure them, he submitted a limit order for $1.10 for the 38.50 strike puts expiring one week away, on April 22nd. His reasoning was that he believed SHAK's price would top $38.50 by the 22nd, despite possible interim moves lower. He was willing to be assigned stock if incorrect in this prediction. His order was filled at $1.13.

He now held ten short put contracts for SHAK at the 38.50 strike, April 22 expiration, for $1.13 premium each.

Interestingly, two trading days later, on Tuesday the 19th, SHAK touched an intraday low of $35.59. Chip's puts would have been expensive to buy back. He did no such thing, however; to the contrary, while SHAK hovered just under $36 that morning, Chip bought five calls at the 36 strike for $0.85 each.

The next day, April 20th, the premium for those calls decreased, despite a slight rise in share price for SHAK. Chip bought five more of the same for $0.80 each.

He now held ten short puts expiring in just two days for the 38.50 strike and ten long calls also expiring in two days for the 36 strike. SHAK's trading range for April 20th was 36.10 - 37.54.

On this same day, April 20th, after having loaded up on long calls for 36 strike SHAK at a cost to him of $825 total (including those purchased the day before), which had the potential to become a total loss to him in two days, Chip assessed the health of this position. With his second purchase having been made during the first hour of the trading day, the last hour approached and call prices had risen significantly. In mid-afternoon, when SHAK prices hovered around 37.50, more or less, Chip liquidated all ten of his long 36 strike calls for $1.30 each. This brought him a profit of $429.50, after broker commissions, for just one day of monkeying around and shaking up the shack a little bit. See summary below:

On Thursday, April 21st, only one day remained in the life of Chip's short puts. See chart above for refresher: He had sold ten puts short for the April 22nd expiration, 38.50 strike, for $1.13 premium received. SHAK's trading range on this day was $36.76 - $37.70. Chip knew that if SHAK ended below $38.50 by the end of the next trading day, he was likely to be assigned 1,000 shares of SHAK, and in fact, he could be assigned those shares at any point prior. He was willing to own those shares, because he believed SHAK share prices would rise in the long run, and he was comfortable owning the shares. But his intention was to avoid taking on shares if possible, and instead to profit from the movement in option prices over short periods of time.

Around midday on Thursday the 21st, one day before expiration, Chip rolled his short puts by doing the following: (see chart below for detail) He bought to close all ten of the above-described 38.50 puts for $1.30 premium each, which was a price higher than what he had opened the short puts for, so he took a loss on this transaction. The loss was $201 after accounting for commissions. Then he opened up new short puts as such:

With a date one week farther out but everything else being identical, he replaced the set of short puts by selling ten SHAK puts expiring April 29th at the 38.50 strike for $1.73 premium received per contract. On the next day, April 22nd, Chip noticed SHAK stock prices rising (see chart again) so that traders weren't hot on the trail of SHAK puts, and premiums softened accordingly. When his week-away puts sported $1.40 price tags - cheap relative to the price he had received - Chip took the opportunity and bought the contracts back to close for a profit. His profit on these rolled contracts paid him back for the loss he had taken on the puts closed the day before, with some extra bonus profit. While his loss had been $201 on the previous set of puts, he made a gain of $299 plus some cents (all figures after commission) on the new transaction, and netted together, that made for about $99 in profit from his put-selling and buying-back venture.

| |

| This chart zooms in on the last two days shown in the previous chart |

Total figures on the short put project are summarized as such:

All told, he made over $500 and never owned any SHAK stock at any point during the put-and-call shuffle. Chip's trades demonstrate that both long and short options can generate profits when traded with attention to daily price fluctuations and an eye on the underlying's price.