Sometimes it's worth letting something simmer on the stove a while to get impressive results, or in this case it's more like letting something ferment in earthenware pots buried in a forgotten location. But the feast five months later is worth the wait and the worry!

Back in September I asked an offhand question of my fellow trader, @Option_Iceman, and received no offhand reply; I quickly forgot about the matter and didn't revisit it again until an answer emerged just a few days ago. The curiosity was momentary; my interest in @Option_Iceman's trade vanished as quickly and surely as would a demanded recollection of what I ate for breakfast on some random day within the last year (actually, I could place a safe bet on that answer since I seem to eat the same thing daily. Uh-oh... boring personality alert!)

To jump right into the middle of the story, note in the below tweet-conversation the five months that elapsed with no answer, during which I excised @Options_Iceman from my list of civil and courteous close friends with whom I share exciting, lucrative wealth-building ideas back and forth like a crew of bandits and outlaws generating the most money anyone can legally... Wait, not really; I simply forgot about the question and went on with my same-breakfast-daily life, not knowing that @Options_Iceman was the one making money while everyone else just gnashed teeth on their daily granola bars, watching the market's red cascade daily and thinking about how we could have made money, but didn't make the right moves at the right time.

Well, here's what @Options_Iceman did to show us all up:

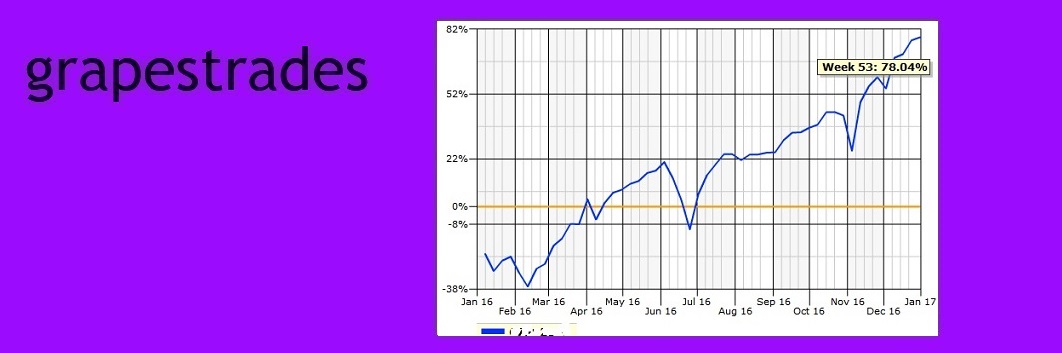

Let's start by looking at what SVXY has been up to for the last nine months:

As pictured below, during one fine day in September, @Option_Iceman saw that even after SVXY's August crash, someone was willing to pay $4.10 at the very top of the call chain, which happened to be 140 strike calls at the time. He sold those calls, told the world about it, ignored my question, and then hunkered down to wait.

Green grass yielded to autumn-colored leaves, then snow blanketed the land; winter solstice plunged us into dark mornings and afternoons peering at flickering red numbers, hands cupped around hot mugs of coffee, crunching our daily granola bars; no one gave a thought to @Options_Iceman and his strategy (unless you paid better attention than I did, in which case you'd see that he sold other calls and puts like the aforementioned bandit all fall and winter. He obviously makes money the way the rest of us just make cups of coffee and peanut butter sandwiches.)

Another look at SVXY, this time with the entry and exit points for @Option_Iceman's short call finagle:

But enough of the SVXY share chart. Let's look at the chart showing options prices that traded for his selection, which was the January 2017 140 strike calls. @Option_Iceman got in while the gettin' was good, obviously, since he took $4.10 of someone's hard-earned money and only had to repay 5 cents to the poor schlub.

The only thing @Option_Iceman could have done to be Impossible Genius of the Year would have been to sell those calls at their highest historical price. That is to to say, right around the tippy-top of SVXY's wingding of a YTD party, its culmination of non-stop buyer-profit revelry going on six-months strong, which is another way to describe mid-August of 2015. Someone was writing those contracts for eighteen dollars and I wonder what kind of robots those people are. Is anyone smiling about this, somewhere, or has someone's heart and brain been replaced with circuits? Or were those contracts traded out of the next day, all the way down the slip-and-slide? Questions I don't have answers to, but I ponder between one cup of coffee and the next. See interesting call price chart for the January 2017 SVXY 140 strike call below:

Those calls now [as of Feb. 22] trade at 25 cents each, which is a significant difference from @Option_Iceman's bargain 5-cent buy-out price. It's especially significant since the contract still has nearly a year to run and with fluctuations in SVXY's price, anything goes. So, even though he didn't scrape every morsel off the $18 drumstick (did anyone?), no one can fault him for spending a nickel to make four dollars, a fine options-trading move by anyone's standards.