Let's look at a slice of time we will call May 5th through July 9th. This represents eight weeks of short call spread management for which I have tracked data which is about to be unpacked in detail.

Of significant note is that VIX traded in and around the 19.00 point on both May 5th (the day I opened the first spread in this series) and July 9th (the day the last spread in the series expired.)

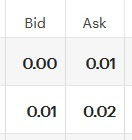

Selling call spreads on UVXY either just above the money or way above the money (well, as far above the money as I could while still collecting premium worth my while), I took on a risk that looked like this: For every dollar in maximum loss I might incur, I hoped to actually lose nothing but instead make 22 cents. 22 cents represents the maximum profit my spreads would make, in the hoped-for event they'd expire worthless after the credit (with debit netted against it) was deposited in my account at the outset of the trade. $1.00 in this equation represents the maximum loss I'd sustain upon exercise, should both call strikes expire in the money. That's the worst-case scenario for a short call spread.

In other words, to enter this room and play the game, I had to hold up a dollar, pledging to hand it over should I roundly lose the game. But I hoped to instead make, in the case of this particular series of spreads I opened sequentially over the eight weeks, a maximum of 22 cents.

As stated above, I didn't do this all in one trade; I opened eight spreads and let them each expire, except for two. Those two were closed by me before expiration because they weren't going well. As it happens, those were the first two in the series (way to start a baseball game by striking out for the first two innings.) After that, the remaining six spreads came in for maximum profit, so the end result was: I didn't lose either the maximum $1.00 or any amount under it; I came out on the winning side. But instead of the maximum 22 cents striven for, I actually brought in 7 and a half cents. Yes, I only brought in about a third of what I hoped to.

Doesn't sound so great, right? Consider that I dealt with many contracts. So I ended up with +$, and I'm never going to complain about that.

This was a series of trades in which the running profit/loss total changed with each new transaction. I started out with a result that was pretty much break-even, then took something approaching max loss on the next spread. I could have handled that one better, but I watched in resentful denial sprinkled with a good helping of wishful thinking until I finally salvaged what I could before expiration. Then, to cheer me up dramatically, the next six spreads expired in textbook max-profit fashion. When you're down in a pit, you can sit there and think about it, or you can start climbing out, which is what I did. I faced the fear (of additional loss) and pressed forward.

Why did I end up making a profit? Was it because the underlying security went my way over the course of the eight weeks (nine, including time to expiration on the last)? See the VIX chart. It wasn't that the VIX declined - in fact you can see a dramatic spike which was not unrelated to my one bad outcome in this series - but the underlying security, UVXY, did decline between May 5th and July 9th. While I don't always know what the VIX will do, I have a reliable idea of what UVXY will do under various conditions as compared to the VIX. Understanding the movement of my security - not predicting it with complete certainty over all timeframes but simply knowing what makes it move and in what direction under different circumstances - allows me to employ a strategy with better chances of success than average.

Follow me on Twitter: @grapeswhiz