Another one added to the bottom of the list, changing the totals:

Friday, October 23, 2020

Updating the list of pranks I have so far pulled on UVXY

Thursday, October 22, 2020

Raking the money off the far side of the table

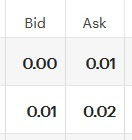

One of my strategies lately has been selling call spreads against UVXY. Hunting for premium at, or preferably above, the current trading price, I set up 1 - 1.5 width credit spreads, and so far, all of them have paid off in their entirety by expiring worthless (I closed none early or for less than maximum profit) except one, which was assigned to me. That was the day the president announced being infected and the market had a major conniption. I could have handled that one better but I ended up taking the maximum loss on it. Here is the list of spreads:

Friday, October 9, 2020

How to lock in a gain on that short while keeping it open

If anyone is curious about what I did with yesterday's trade, I walked it down the hill. Of course the sizeable gain on the short is tempting, but my goal is to keep this open and continue chomping bites off the downside, so long as market conditions allow. Here is a write-up of the trade I described yesterday and today's changes.

As you can see, if next week the VIX-cano erupts, I can just exercise those calls and close the whole thing out. Margin requirements would also increase on the position, should a rocky week force me to wait it out through share prices higher than the strike of my most-recently bought calls.

Thursday, October 8, 2020

How to get a no-cost, risk-free short

Just kidding - nothing is free - and in this case what I gave up was a profit sitting there ready for the picking. But I wanted to short this security without paying for the privilege, so without actually paying (so yeah, it WAS free if you don't count the profit I could have taken that I chose not to), I got what I wanted.

Everyone who knows me knows that I'm always trying to make money off the downside of UVXY. Here are the nuts and bolts of how to attempt getting in for free:

Shorted a few days ago at exactly the price of 20.50 and also got calls against those shares at the same strike. So the math (ignoring commissions) goes like this:

500 UVXY shorted at 20.50 is a credit of $10,250

5 UVXY Oct9th 20.50 calls were 0.89 each, or a cost of $445

Should Friday the 9th come, and the need to exercise arises, and there's no way to skim anything off either direction of those liabilities, the worst case scenario would be an exercise at 20.50, so no loss or gain on the stock, and the entire option cost of $445 flies away to bye-bye land.

After turbulent Tuesday, wishy-washy Wednesday and thrilling Thursday, UVXY went down the 18.00 sliding board and landed in the sand looking at sweet seventeen. So today I decided, instead of taking a $500 or so profit that I could take (anyone thinking I'm foolish right about now? It could be true!) I decided to pursue my dream of the risk-free, cost-free short.

Leaving the shares undisturbed so as not to alert them that anything is up at all, I stealthily bought 18.50 calls for next week at the going rate of 0.96 or another $480 debit to me. Bringing in the consolation prize of just 5 cents on the previous options netted $25, bringing my new total pile of options cost to $900.

But since my new strike is 18.50, should I have to exercise next week, I'd bring in $2 per share on those shares shorted at 20.50 for a $1,000 boost to my account and a total max loss of $900 on the options, for a $100 gain overall. I consider this basically flat, or a chance to keep this short going and hope that eventually I can expand the size and widen the gap between my costs and worst-case profits. Who knows what the future will bring, but I started three days ago with nothing but an idea, and now I'm in the game for free.

Friday, September 25, 2020

Nerve Tester

It was a nerve-tester yesterday and even today (see orange arrows for a few examples of un-fun moments):

But the end-of-day report was a good one:

Prices on those things as of 3:59 PM:

Another one brought it for total maximum profit.

Follow me on Twitter: @grapeswhiz

Friday, September 18, 2020

I simply hoped I wouldn't botch it

Ringing the register, closing the till. Til next week. Happy weekend to all fellow traders - may you celebrate your good trades, or forget your bad ones and look forward to future good ones.

Wednesday, September 9, 2020

Should I just give up?

I think of myself as someone who makes reasonable efforts to keep up, or who really just stays near the forefront effortlessly through my default state of absorbing and reading during each waking moment the same way I breathe on a constant basis (doing the latter even in my sleep), but obviously I have slipped behind if I failed to notice "Fintok." If the financial advice is now being dispensed on TikTok, I should just turn in my keycard right now.

Had it not been for @chigrl letting me on this, I'd forever be uninformed. Financial community - Stop the ride! Let me off!

Friday, September 4, 2020

Another day, another 96 cents (per contract)

Instead of combing the halls of Twitter for wit and wisdom, today I'll simply paste a copy of my doings that turned out to provide a little Friday paycheck (but could have sent me down the hall for a visit to the Principal's office or at least a red-ink reconciliation in the accountant's office.) I went out on a limb yesterday and came back in, and I brought back a little bit from my hunting and gathering expedition.

The profitable life isn't a predictable life, and while I could just pick up pennies in front of the steamroller as some underwear trader accused me of last week, it's not my style, so I prefer to suffer through middle-of-night future-checking and pre-market wake-up times, and also daytimes sometimes too stressful to remember to eat, so I can go for the dollars and not the pennies.

Thursday, September 3, 2020

Ramp or plunge?

The age-old question plaguing weary traders at the end of the day when all the coffee has been run through and the dreams have been dashed (or fulfilled with maniacal loud proclamations) - will the day end in a ramp or a fizzle?

Here, some keyboards have been slammed and a few curse words uttered. Would that be surprising?

Looks like both Pete Phillips (@pistolsout) and dave dave dave (@davedavedave224) were right. And the majority of voters (including myself, voting without looking just so I could open up the poll results for display) were wrong.

Wednesday, September 2, 2020

Commentary not investment advice

A reminder from Jeremy is that his commentary is not investment advice.

Tuesday, September 1, 2020

Where she stops, nobody knows

As after-hours trading is a little elevated, Twitter pundit "D" (@FigureNyenterms) of the inscrutable handle and display name provides a hazy, clouded magic-8-ball-style prognostication for the morning (I think.) Since there wasn't much punctuation, his (or her) reckoning is open to interpretation.

Now, I don't know who would be in their pajamas at four in the afternoon, other than those who never shed them throughout the duration of the day. And I strongly suspect that "D" is, in fact, in pajamas if anyone is. But the important point here is the sentiment: That the open will be lower tomorrow. We all put our pajamas on one leg at a time, and none of us really know what's going to happen, but there's a good chance "D" will wake up doing the "Told You So!" strut.

**Edit: Clarification from FigureNyenterms says that he is trying to outsmart the pajama traders who are interpreted to be voting with their trades for a lower open, while he sees the open higher. **

Monday, August 31, 2020

What's better than premium? DOUBLE premium

Two scoops, please. That's what UVXYTrader (@michaellistman) said this morning when he got a scoop of put premium and a scoop of call premium on his ice cream cone. With UVXY trading at approximately 21.90, he brought in 86 cents of premium per contract on some puts for the 21 strike expiring this Friday and 1.77 per contract on the associated calls, all of which he sold short. Let's see what happens for the rest of the week and how this trade comes to a close through some method or another. 2.63 (or $263 considering the type of contract these were) was deposited into his account, per contract (of which the quantity is unknown or let's say, it's not going to be discussed here, at any rate.)

Later in the week we will discuss the eventual resolution of this contract, wishing the best possible outcome for UVXYTrader.

Friday, August 28, 2020

Math Wins

While "Math Wins" (AKA "Let's Move Money") is looking for $UVXY to rip, I'm always looking for it to slip.

Here's my math for today:

While thieves are looting from one door of your business, as long as you are ringing the register to a greater degree at the other door, you can close up shop at the end of the day and count your profits.

Thursday, August 27, 2020

That's a fast steamroller

It may not have been me, but I feel quite sure that some people picked up more than pennies today (and that others came out "flat," and by that I don't mean no profit or loss - I mean what the steamroller does to you.)

Below I get schooled by a 15-year-old hedge fund manager:

Who has stories today about surviving (or not) the VIX carnage?

Wednesday, August 26, 2020

grapes trades on

Party on, Wayne. Party on, Garth. Trade on, grapes.

Watch this space to see if and what I feel like talking about. Let's talk first about the conversation I see tonight on Twitter.

This man, who goes by the name of "Bat," if I remember correctly, has expressed his observation that the VIX is acting in an uncharacteristic manner this afternoon. Fellow trader with a cat for an avatar postulates that the Fed will be the arbiter of which way the horse manure drops when it does. Plop, plop, plop - VIX will do the drop, drop, drop. Let's all crowd around (at a safe distance) to see it happen tomorrow.

Friday, May 1, 2020

Mayday

Starting TODAY! (edit as of August 2020 - don't go look for those tabs - they are currently down for repair, but will be back up eventually.)