It isn't the end of the year yet, but here it comes. Three more trading days and we can wrap it up.

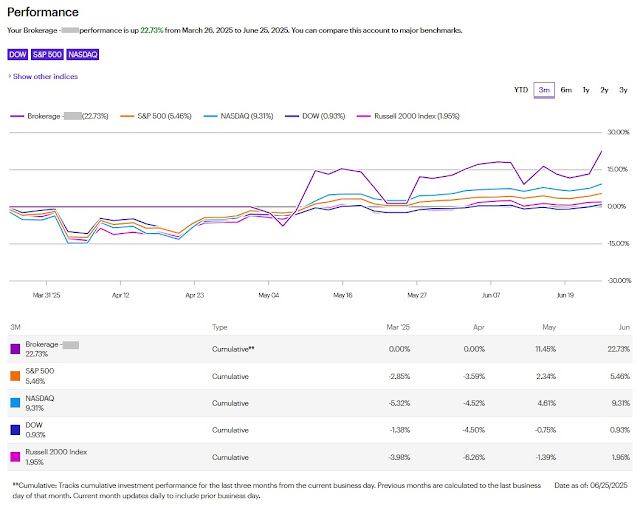

Here's my snapshot (you'll have to expand it to see the deets.)

My stake, which keeps getting smaller, and that's a crime I should do something about: (remember these are subject to a multiplier)

$35.04

My updated results:

$136.53

I'm shaking a few things up for 2026. Closing down one currency account, keeping another open, and striving to use the futures account more. See ya back here in a few days when I have a true wrap to the year. Hope you're enjoying eating holiday leftovers like I'm doing at this very moment.

follow me on Twitter: @grapeswhiz